2022 tax brackets

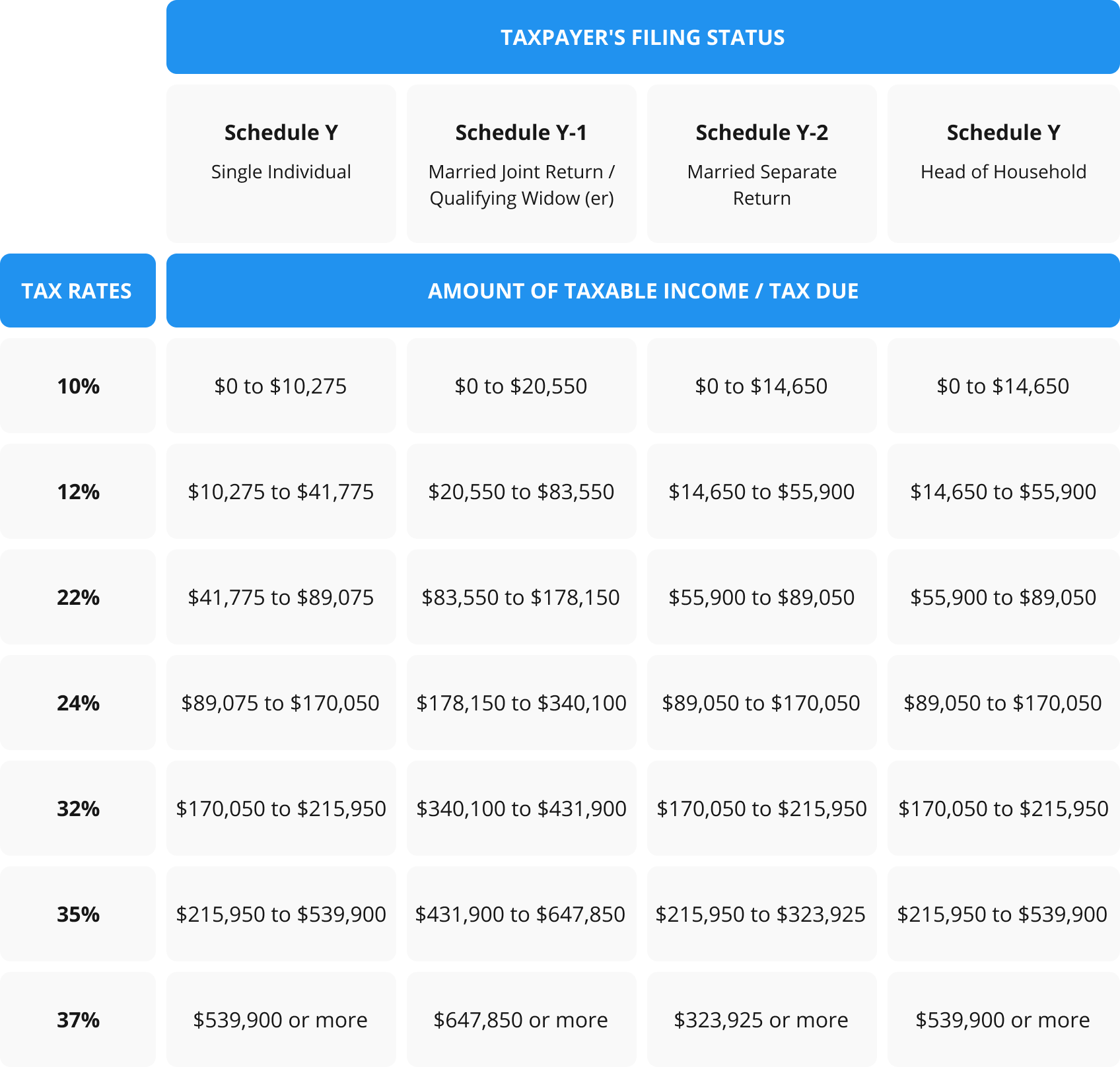

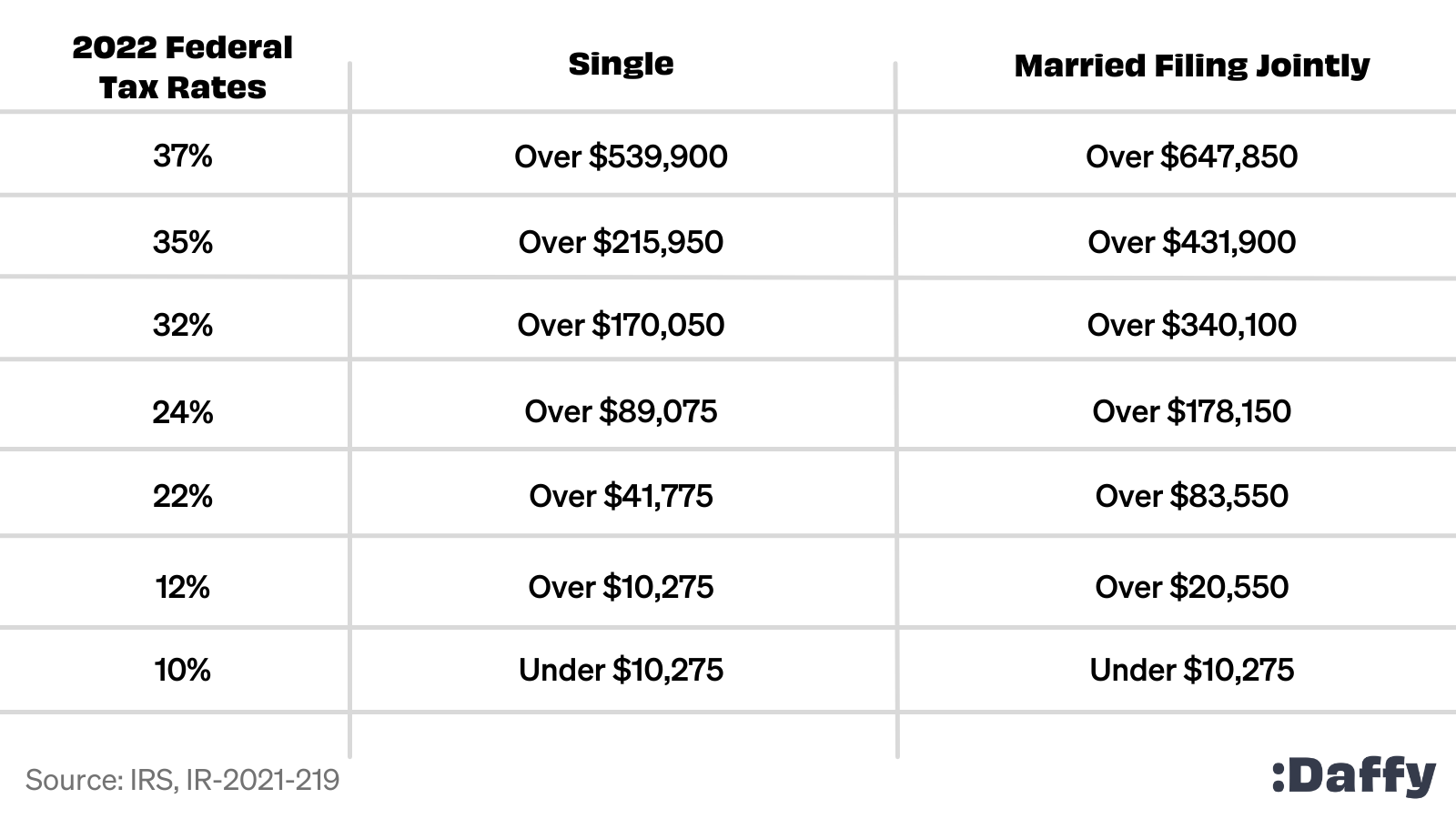

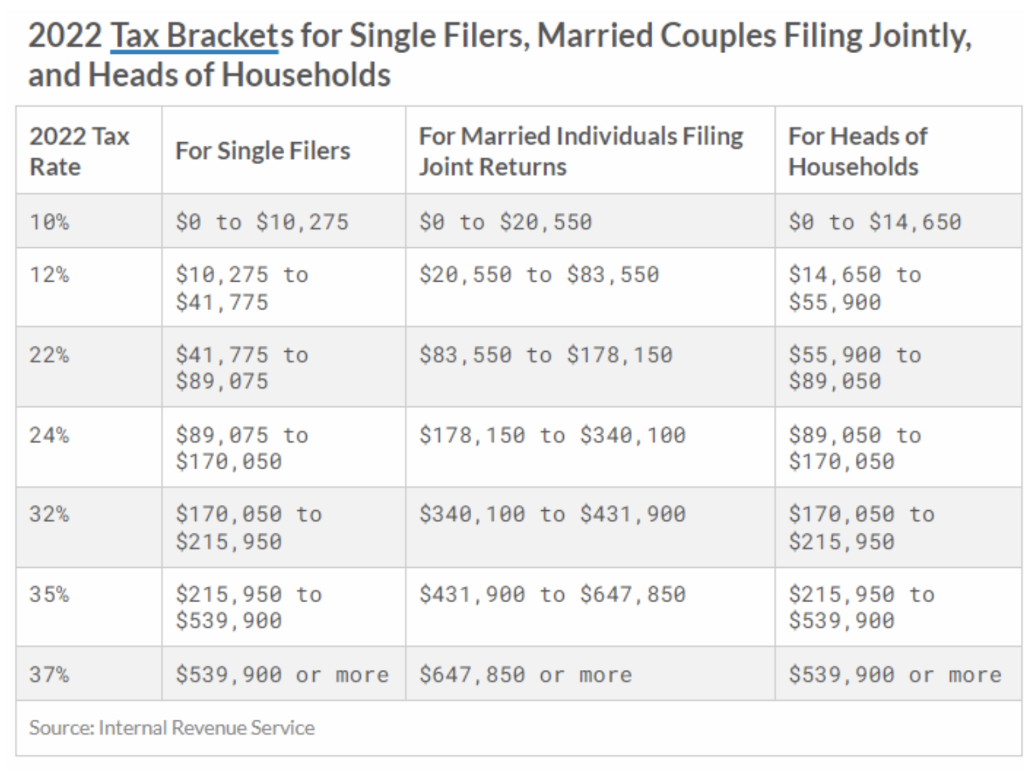

There are seven federal tax brackets for the 2021 tax year. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

Federal Income Tax Brackets For 2022 And 2023 The College Investor

Resident tax rates 202223 The above rates do not include the Medicare levy of 2.

. The 24 bracket for the. This guide is also available in Welsh Cymraeg. The IRS adjusts tax brackets annually using an adjusted version of the US governments Consumer Price Index.

Here are the new brackets for 2022 depending on your income and filing status. A married couple can pass on double that. Tax brackets 202223 Class 1 employed rates For employees For employers Please note.

Forms printed from the Internal Revenue Service web page. The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. Below you will find the 2022 tax rates and income brackets.

IRS releases higher 2023 tax brackets standard deductions inflation adjustments Published. Your bracket depends on your taxable income and filing status. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

2022 tax brackets. 10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140. The seven brackets remain the same 10 12 22 24 32 35 and 37 which were set after the 2017 Tax Cuts and Jobs Act.

Whether you are single a head of household married. Single filers may claim 13850 an increase. To access your tax forms please log in to My accounts General information Help with your tax forms Fund tax data 2022 tax.

Fuel excise halved for a period of 6 months from 30 March 2022. So for example the lowest 10 ordinary income tax bracket will cover the first 22000 of taxable income for a married couple filing jointly up from 20550 in 2022. There are seven federal income tax rates in 2023.

That will be welcome news for many people whose salaries havent been keeping up this year with the. The estates of wealthy Americans will also get a bigger break in 2023. Taxable income up to 20550 12.

Americas tax brackets are changing thanks to inflation. These are the rates for. 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household.

The next chunk up to 41775 x 12 12. Estate tax limit. The IRS will exempt up to 1292 million from the estate tax up from 1206 million for.

19 2022 857 am. Each of the tax brackets income ranges jumped about 7 from last years numbers. For married individuals filing jointly.

Entitlement to contribution-based benefits for employees retained for earnings. Typically the increase is small but this time using the. Break the taxable income into tax brackets the first 10275 x 1 10.

The current tax year is from 6 April 2022 to 5 April 2023. Individuals will be able to transfer up to 1292 million tax-free to their descendants up from just over 12 million in 2022. Residents These rates apply to individuals who are Australian residents for tax purposes.

10 12 22 24 32 35 and 37. So for example the lowest 10 ordinary income tax bracket will cover the first 22000 of taxable income for a married couple filing jointly up from 20550 in 2022. Your tax-free Personal Allowance The standard Personal Allowance is 12570.

And the remaining 15000 x 22 22 to produce taxes per. Heres a breakdown of last years income. 2022 tax brackets for individuals Individual rates.

See various measures announced in the Budget 2022 delivered on 29 March 2022.

Nyc Property Tax Rates For 2021 2022 Rosenberg Estis P C

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Tax Season 2022 Tax Brackets Irs Forms Deadlines Pdffiller Blog

2022 Income Tax Brackets Darrow Wealth Management

Analyzing Biden S New American Families Plan Tax Proposal

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

The Complete 2022 Charitable Tax Deductions Guide

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

How Do Tax Brackets Work And How Can I Find My Taxable Income

2022 Federal Payroll Tax Rates Abacus Payroll

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Solved 1 1pt Assume You Are A Single Individual With Chegg Com

The Truth About Tax Brackets Legacy Financial Strategies Llc

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger