michigan use tax act

176of 2015 will increase the tax on motor fuel and impact the way the Michigan Department of Treasury is required to administer motor. Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

Michigan Family Law Support January 2019 2019 Federal Income Tax Rates Brackets Etc And 2019 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Here in Michigan if you purchase tangible personal property for use in Michigan you have to either pay sales tax to the seller or pay whats called a use tax to the state.

. M Use tax means the tax levied under the use tax act 1937 PA 94 MCL 20591 to 205111. 2015 Act 177 Eff. Aroma Indian Restaurant West.

Over 85 million taxes filed with TaxAct. MCL 20591 Use tax act. This act may be cited as the Use Tax Act.

For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the. Use is defined as the exercise of any right. The People of the State of Michigan enact.

20591 Use tax act. The People of the State of Michigan enact. Under the Constitution presidential nominations for executive and judicial posts take effect.

Over 85 million taxes filed with TaxAct. As a general rule you owe this tax if you purchased merchandise and did not pay sales tax. Imposition of the Tax The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937.

Start filing for free online now. In Michigan that tax is called the use tax but might be more aptly described as a remote sales tax. A recent amendment to the Motor Fuel Tax Act PA.

Tax Collector Near Me Brandon. The amendment to the Use Tax Act will not take effect unless approved by a majority vote at an election that. The Michigan use tax is an additional tax you claim on your return to represent sales tax that you didnt pay.

The following situations are the most common cases where you. Rather this amount will remain part of the state component tax. The use tax was enacted to compliment the sales tax.

USE TAX Michigans 6 use tax is imposed on a purchaser for the act of storing using or consuming tangible personal property in Michigan. Ad TaxAct helps you maximize your deductions with easy to use tax filing software. The use tax act imposes tax on tangible personal property that is used stored or consumed in michigan at a rate of 6 of the purchase price unless.

AN ACT to provide for the raising of additional public revenue by prescribing certain specific taxes fees and charges to be paid to the state for the privilege of engaging in certain business. Start filing for free online now. Definitions As used in this act.

1 The use or consumption of the following services is taxed under this act in the same manner as tangible personal property is taxed under this act. Terms Used In Michigan Laws Chapter 205 Act 94 of 1937 - Use Tax Act Advice and consent. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases through the internet.

History2004 Act 175 Eff. A Except as provided in section. Use tax act This act may be cited as the Use Tax Act.

Michigan Use Tax Act. History1937 Act 94 Eff. USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal.

Mobile Al Sales Tax Rate 2019. Sales and use tax in Michigan is administered by the Michigan Department of Treasury. B Use means the exercise of a right or power over tangible personal property.

This act may be cited as the Use Tax Act. Any sales tax collected from customers belongs to the state of Michigan not you.

Donald Mains In Flint Michigan In 2022 Flint Michigan Community Capital Gains Tax

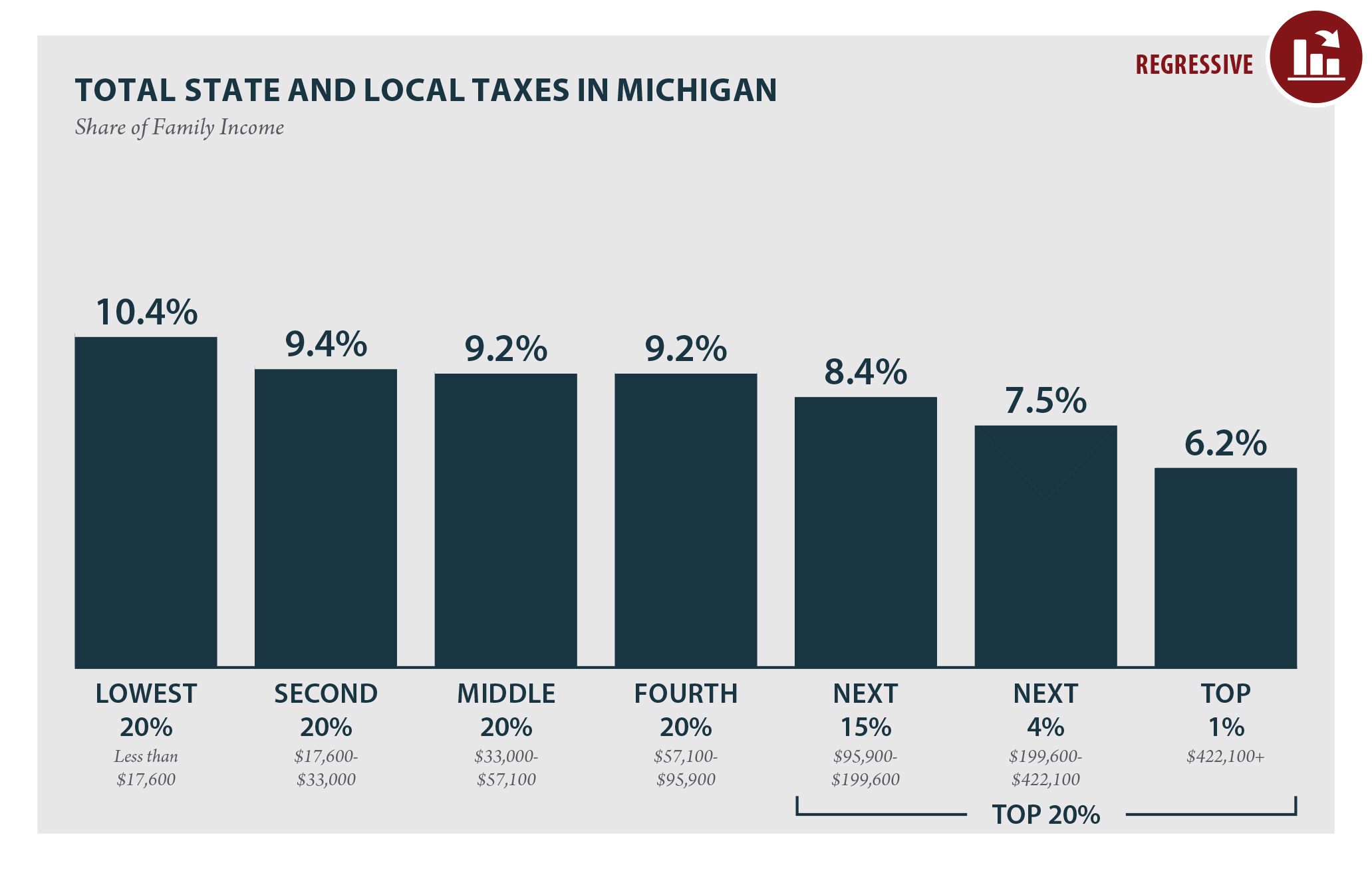

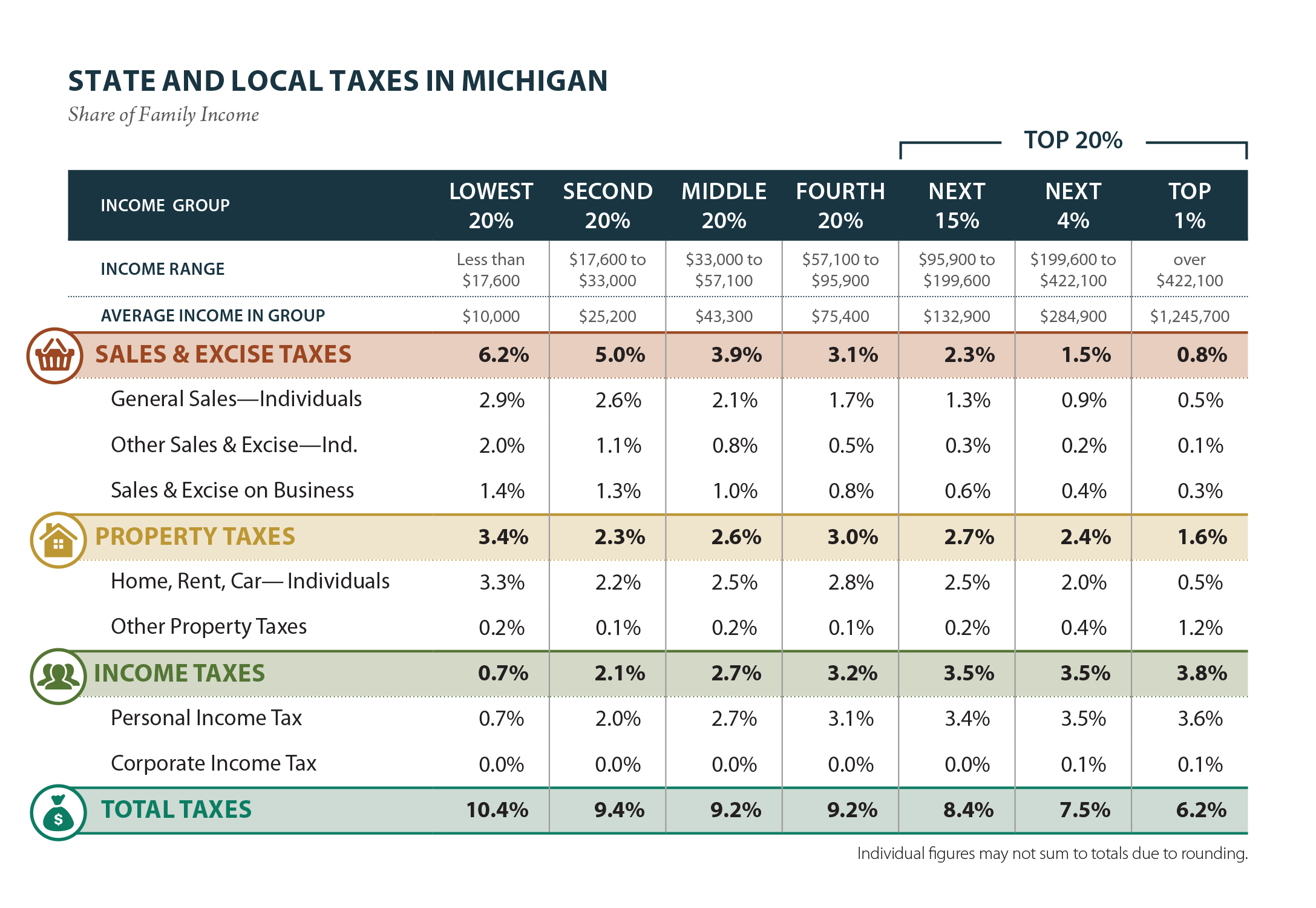

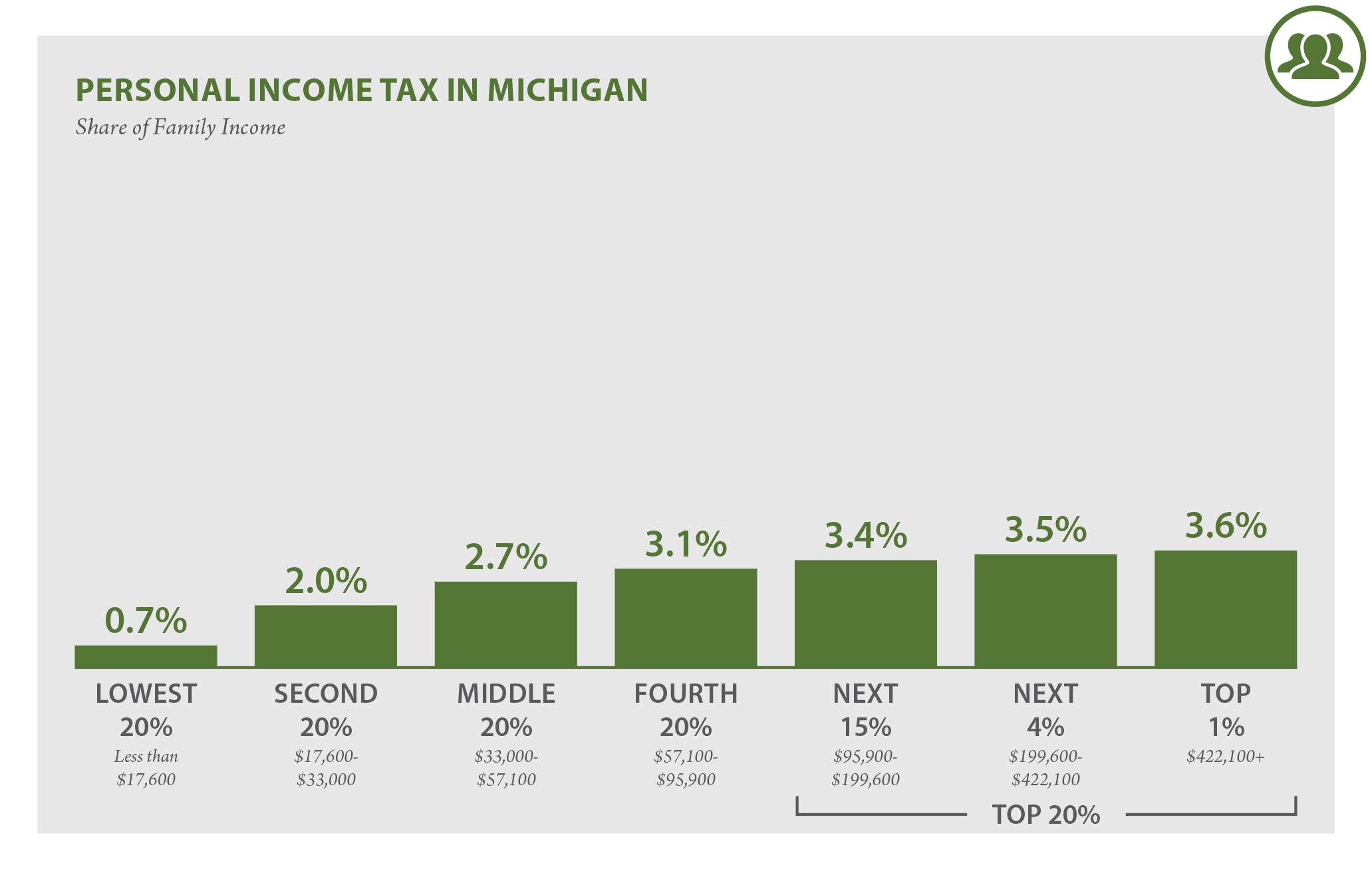

Michigan Who Pays 6th Edition Itep

Estate Financial Services 2016 Family Trust Grow Financial Financial Services

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

The Best Ways To Spend Your Tax Refund Visual Ly Tax Refund Tax Return Income Tax

Michigan Sales Tax Small Business Guide Truic

211 Provides Countless Resources Thruoghout Southeast Michigan School Related United Way Health Care

State Of Michigan Taxes H R Block

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Michigan Intestate Succession Flowchart Estate Planning Attorney Estate Planning State Of Michigan

What Transactions Are Subject To The Sales Tax In Michigan

Free Michigan Power Of Attorney Forms Pdf Templates Power Of Attorney Power Of Attorney Form Attorneys

Where S My Michigan State Tax Refund Taxact Blog

Michigan Real Estate Power Of Attorney Form Power Of Attorney Form Power Of Attorney Power

Michigan Who Pays 6th Edition Itep

Pursuing A Michigan Asbestos Injury Claim Mesothelioma Lawyers Tax Attorney Tax Lawyer Injury Claims

Michigan Tax Power Of Attorney Form 151 Power Of Attorney Form Power Of Attorney Thank You Letter Examples